Is Customer Tax Exempt?

If the selected customer is tax-exempt taxes will always be 0.

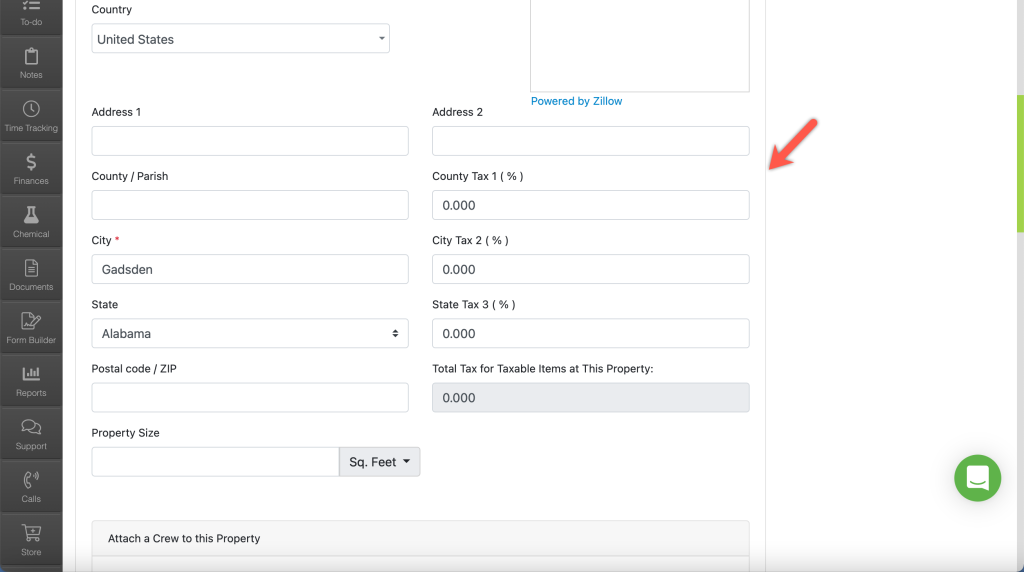

Property Settings

You can add entries to the property’s Items & Services section and also set their tax values.

If you selected a property for your line item we are going to check if you have a matching Items & Services entry for that property and we’ll use the tax value of the matching Items & Services entry.

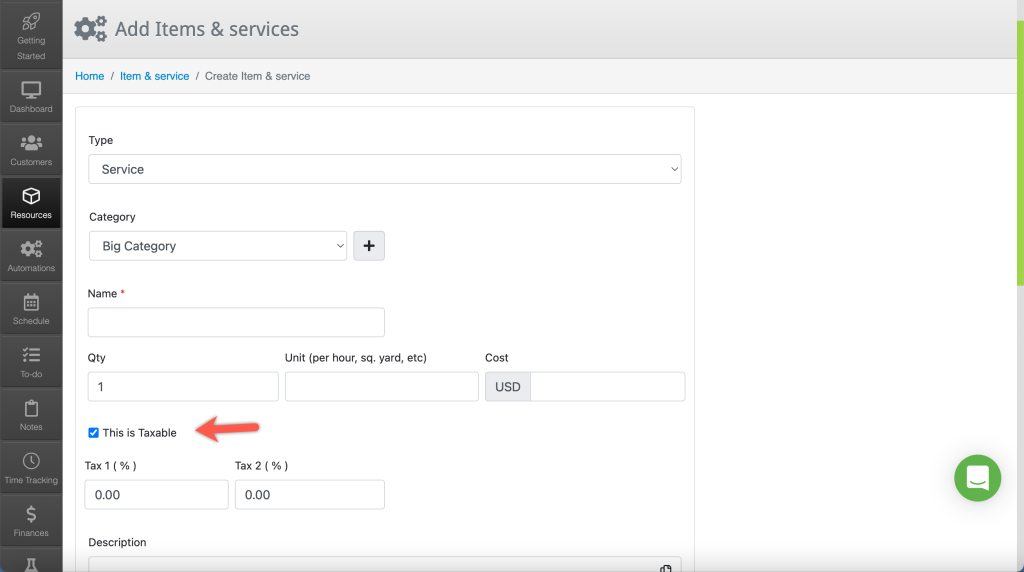

Line Item Dropdown

If you choose a line item from the dropdown when creating a visit, invoice, or estimate, we are going to use the tax value that was used in the past for that line item.

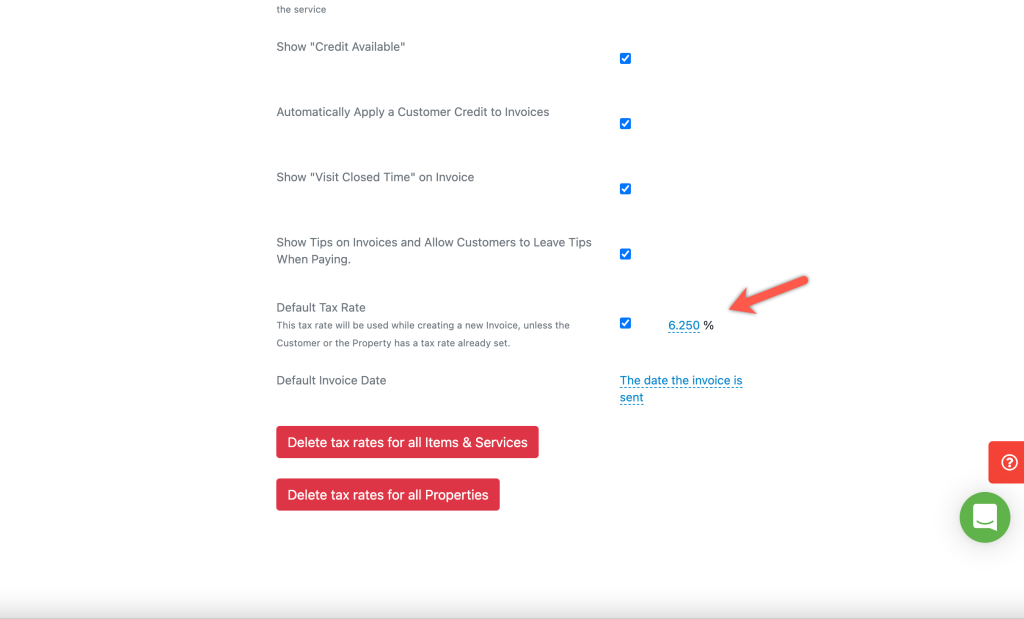

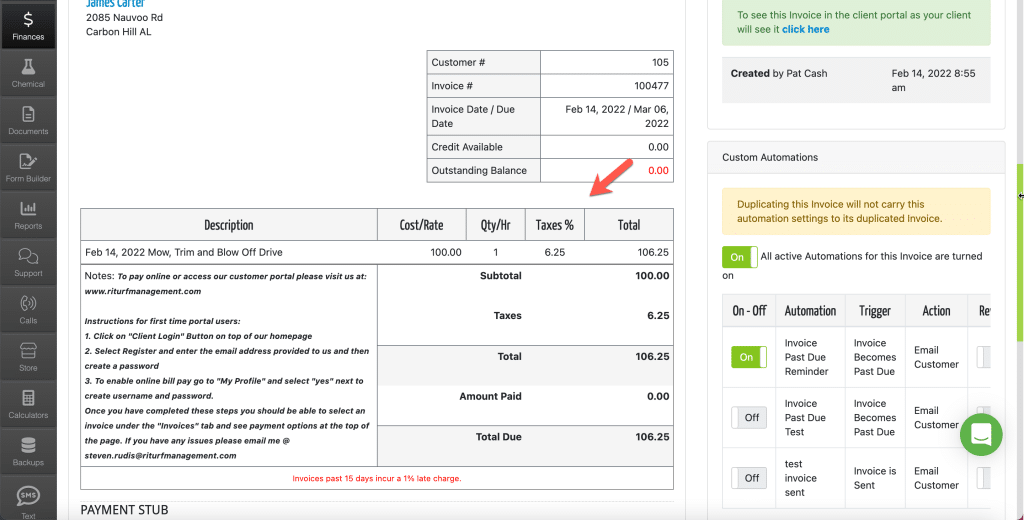

Your Default Tax Rate

If none of the above apply we will just use your default tax rate (if it’s set).

The default tax rate can be set on the Settings > Invoices & Estimates page.